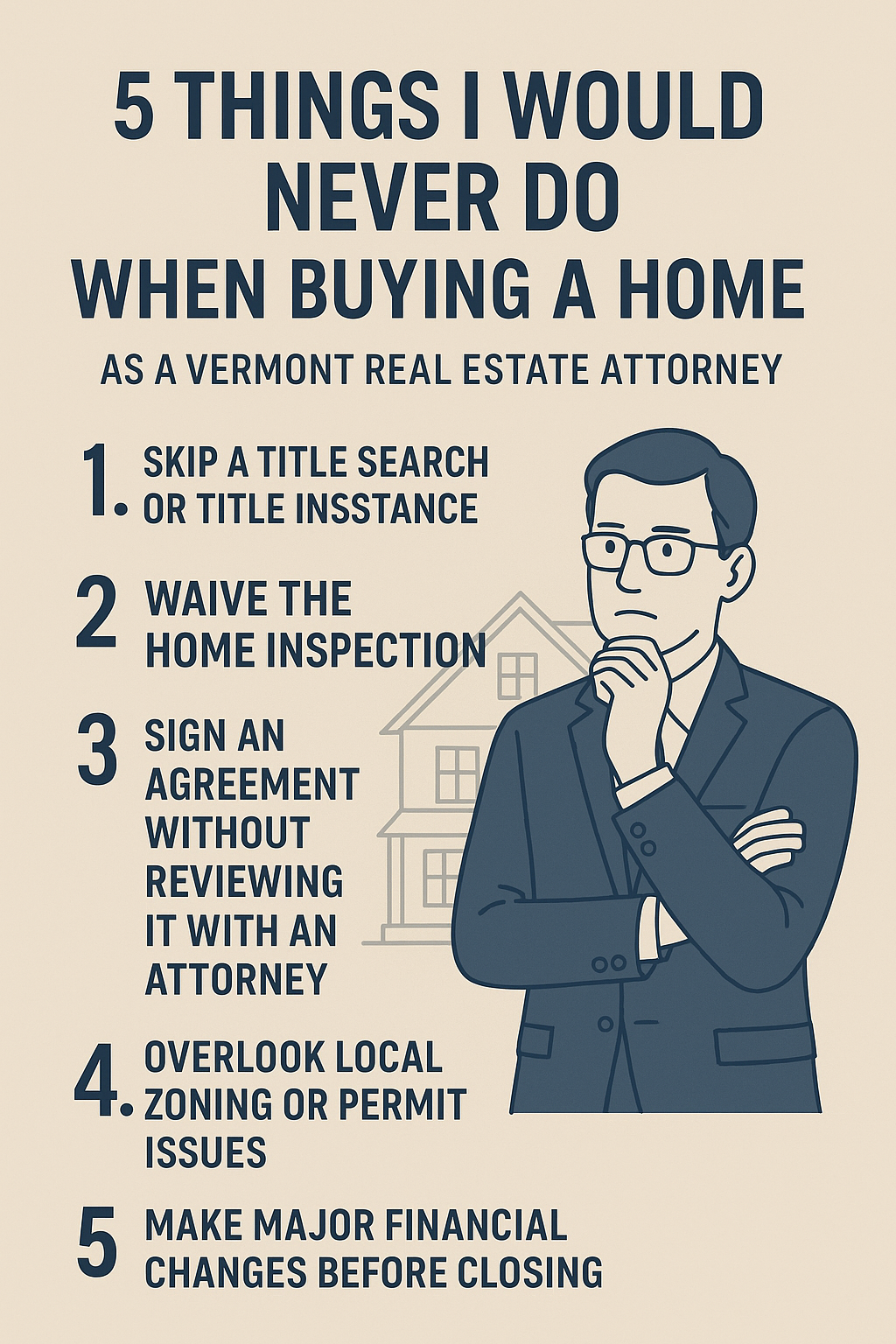

5 Home-Buying Mistakes You’ll Want to Avoid

Here are five things I would never do when buying a home, based on my experience representing Vermont buyers and sellers for decades.

1. Never Skip a Title Search or Title Insurance

Even if the property looks perfect, you need to know you’re getting clear, marketable title. A professional title search can uncover liens, easements, boundary issues, or old mortgages that could create major problems later.

Title insurance protects you if something unexpected arises after closing — for example, an undisclosed heir claiming ownership. In Vermont, title insurance is a relatively small cost that provides peace of mind for as long as you own the property. Skipping it is never worth the risk.

2. Never Waive the Home Inspection

A home inspection isn’t just a formality — it’s your opportunity to identify defects and negotiate repairs or credits before closing. Vermont’s older housing stock often hides issues like foundation cracks, mold, aging septic systems, or outdated wiring.

Even in a competitive market, I would never waive an inspection. A short-term advantage to win a bidding war isn’t worth the long-term cost of discovering major structural or safety problems after you move in.

3. Never Sign an Agreement Without Reviewing It With an Attorney

Real estate purchase and sale agreements in Vermont can contain contingencies, deadlines, and legal obligations that vary from one transaction to another. Once you sign, you’re legally bound.

An attorney can help you understand every clause and ensure your interests are protected — especially concerning financing, inspections, and closing conditions. At Peet Law Group, we routinely catch issues in contracts that could have cost buyers thousands of dollars or led to disputes down the road.

4. Never Overlook Local Zoning or Permit Issues

Before buying any home in Vermont, it’s essential to confirm that the property complies with local zoning and that all improvements — such as additions, decks, garages, or finished basements — were properly permitted. Unpermitted work can lead to fines, costly repairs, or delays if you ever plan to sell. Your attorney can review municipal records and zoning maps to ensure the property’s current use and structures are fully compliant. Catching zoning or permit problems early can prevent serious headaches later.

5. Never Make Major Financial Changes Before Closing

Your lender will likely verify your financial stability right up to the day of closing. Making big purchases, changing jobs, or taking on new debt can jeopardize your mortgage approval.

I’ve seen closings delayed — or canceled — because a buyer bought a new car or opened a line of credit just before closing. Once you’re under contract, keep your finances steady until the deal is done.

Final Thoughts

Buying a home in Vermont should be exciting, not stressful. By avoiding these five mistakes and working with an experienced Vermont real estate attorney, you can protect yourself, your investment, and your peace of mind.

At Peet Law Group, with offices in Williston and Hartford (White River Junction), we guide homebuyers through every step of the process — from reviewing purchase contracts to resolving title issues and ensuring a smooth closing.

If you’re thinking about buying a home in Vermont, contact us today at www.peetlaw.com