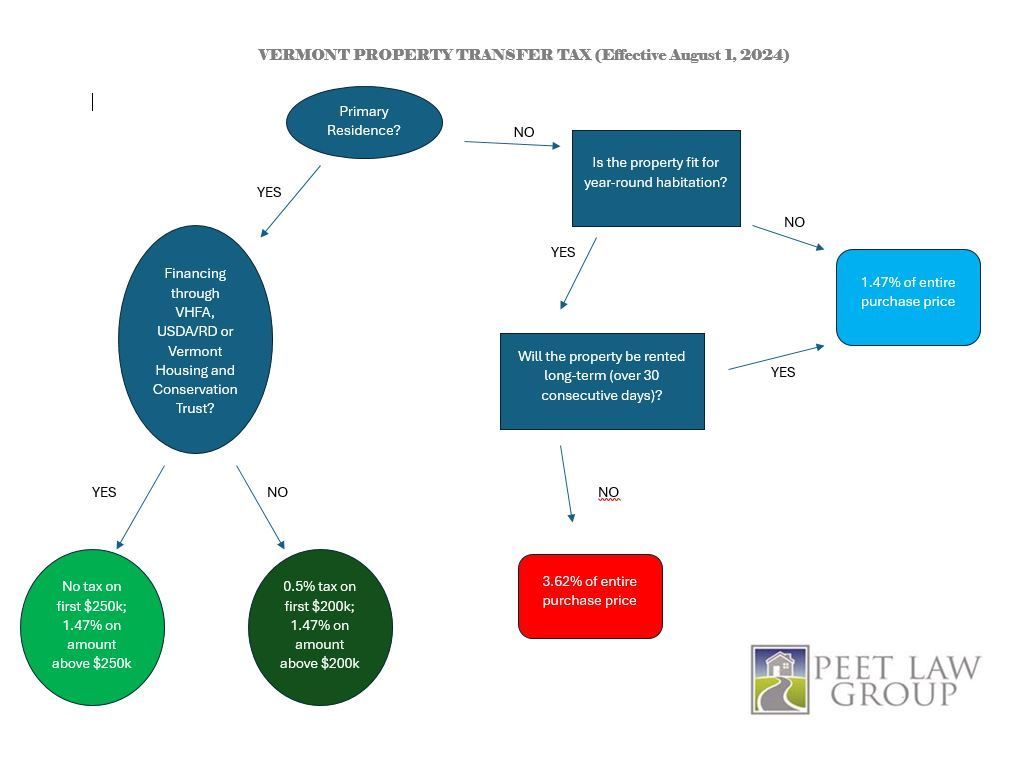

Vermont's Property Transfer Tax Explained: Who Pays More—and Who Pays Less

Vermont’s property transfer tax structure includes important distinctions that significantly impact both buyers and sellers in residential real estate transactions. Whether you’re purchasing a second home, a primary residence, or a rental property, understanding how these tax rates apply can help you better plan your transaction. Here’s a detailed breakdown of the current structure:

Key Aspects of Vermont’s Property Transfer Tax

1. Higher Tax Rate for Certain Second Homes

Some residential properties are subject to a higher transfer tax rate of 3.62%. This rate applies only if all of the following conditions are met:

- The property is residential and suitable for year-round habitation,

- It will not be used as the buyer’s primary residence, and

- The buyer is not required to file a landlord certificate.

The landlord certificate is a filing with the Vermont Department of Taxes that landlords must submit if they rent a property for 30 consecutive days or more, allowing tenants to claim the Renter's Rebate. If a landlord certificate is required, the 3.62% rate does not apply.

It’s important to note that not all non-primary residences are subject to the 3.62% rate. The following property types are generally taxed at 1.47%:

- Unimproved land

- Seasonal camps

- Commercial properties

- Long-term residential rental properties

2. Reduced Rates for Principal Residences

Buyers purchasing property for use as their principal residence benefit from lower tax rates:

- 0.5% transfer tax on the first $200,000 of the property’s value

- 1.47% on the value above $200,000 (inclusive of the clean water surcharge)

Additionally, if the buyer obtains a purchase money mortgage through a homeland grant from the Vermont Housing and Conservation Trust Fund, or financing from VHFA or USDA Rural Development, the first $250,000 of the purchase price is fully exempt from the transfer tax. Amounts above that are taxed at 1.47%.

3. Clean Water Surcharge

A clean water surcharge of 0.22% is included in the 1.47% rate applied to the value above the $200,000 threshold on principal residences. However, the surcharge does not apply to the first $250,000 of value if the purchase qualifies for the exemptions mentioned above.

What This Means for Buyers and Sellers

- Second Home Buyers: Those purchasing a qualifying second home should carefully consider the impact of the 3.62% rate on their total acquisition cost.

- Primary Home Buyers: The reduced tax on the first $200,000—and potentially up to $250,000 if using qualifying financing—can result in substantial savings.

- Sellers: Being aware of how the transfer tax applies can help you market your property more effectively, especially if it appeals to primary residence buyers or long-term investors.

Vermont’s property transfer tax rates are nuanced and vary depending on how the property will be used and how it is financed. Whether you are buying a home, investing in a second property, or preparing to sell, it’s essential to understand how these rules apply to your specific transaction.

If you have questions about how the transfer tax may affect your closing or need legal assistance with your real estate transaction, the team at Peet Law Group is here to help. Contact us today for personalized, knowledgeable guidance throughout your home-buying or selling journey.